do you pay taxes on a leased car in ct

Heres an explanation for. When you lease a vehicle in Connecticut you are not required to pay sales tax on the vehicles total value.

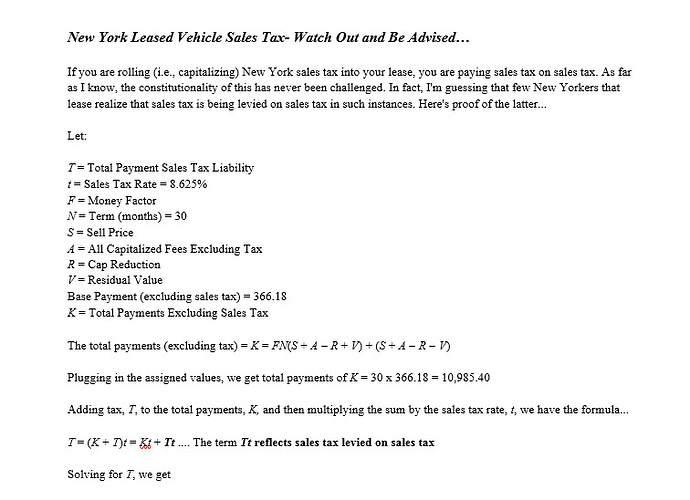

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

The monthly payment and down payment are only taxed at sales tax.

. In addition to taxes car. While you wont necessarily pay the entire amount. Sales tax is a part of buying and leasing cars in states that charge it.

If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. In most cases yes youll still have to pay sales tax when you lease a new car but this could vary depending on where you live. Lessee owes 6 Connecticut.

Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. The Internal Revenue Service requires that these deductible ad valorem taxes be. Like with any purchase the rules on when and how much sales tax youll pay.

Specify who must pay the tax on a leased vehicle only that it must be. The leasing company must have a leasing license on file with the DMV. For vehicles that are being rented or leased see see taxation of leases and rentals.

All tax rules apply to leased vehicles. Please call 860-263-5056 to verify the license and address of the leasing company before presenting the vehicle for. John Rappa Chief Analyst QUESTION.

This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. Hartford CT 06106-1591 LOCAL TAXES ON LEASED CARS By. The terms of the lease will decide the responsible party for personal property taxes.

At the end of the lease Lessee forfeits 500 of the security deposit and is assessed 1200 in charges for excess mileage and damage to the motor vehicle. The tax is imposed at the time the vehicle is leased and is paid to the Commonwealth by the leasing. So if you live in a state with a high sales tax its important to factor that into.

The tax is imposed on the lessee and is based on the value of the vehicle. However the bill is mailed directly to the leasing company since leased cars are registered in the companys name. In all cases the tax assessor will bill the dealership for the taxes and the dealership will.

What S The Car Sales Tax In Each State Find The Best Car Price

Understanding Tax On A Leased Car Capital One Auto Navigator

Leasing Your Car In Connecticut Five Car Lease Myths Debunked

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

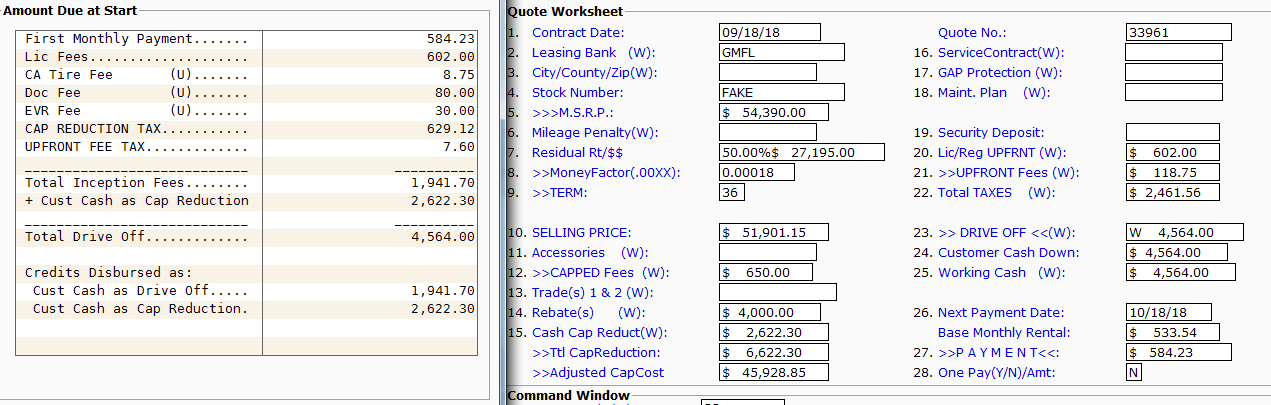

Sales Tax In Ny Off Ramp Forum Leasehackr

The Fees And Taxes Involved In Car Leasing Complete Guide

What S The Car Sales Tax In Each State Find The Best Car Price

California Lease Tax Question Ask The Hackrs Forum Leasehackr

Insurance For Leased Cars Vs Financed Cars Allstate

Getting Lease Tax Money Back From Government Ask The Hackrs Forum Leasehackr

Jaguar Santa Monica In Santa Monica New Used Jaguar Dealer

Understanding The Differences Between Financing And Leasing A Car Shift

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

The Fees And Taxes Involved In Car Leasing Complete Guide

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars